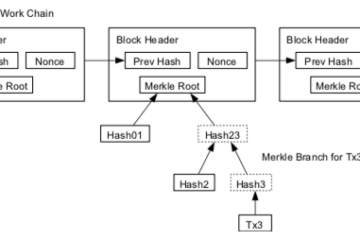

Block Explorers have been gradually improving over the past few years and they do what they do well, but that’s not such a challenge when they don’t do very much. They are mostly a graphical display for a blockchain node.

A blockchain based financial system is unlike any we have had before because it is built on a shared public database of all transactions ever performed. This gives us an incredible resource for data mining and a block explorer could be the perfect platform to build such a public data service.

May I present, Block Explorer 2.0? No, sadly I may not, as none exist. yet. But at least one project I know of still is in the works may fit this new category. An enhanced block explorer is something I have been mulling in the back of my mind for a couple of years and I’m surprised none have popped up as yet. The features I am waiting for and would hope to see in a new generation of data services would include…

- Address clustering: This is something forensic analysis tools such as Chainalysis, ScoreChain and Elliptic offer however this is based on their proprietary intelligence work and therefore not available publicly. Addresses are flagged and marked up with any known information, such as whether it is a deposit address for a crypto exchange, or whether it was used to receive funds from a strain of ransomware. Layering such metadata on to the chain allows otherwise invisible patterns to emerge which can be useful to traders, researchers and investigators. What’s more such techniques are far more successful when fed by the crowd (à la Wikipedia) rather than a small team of paid staff. Novel insights may be gained by tracing activity between pairs or groups of addresses which may have no otherwise obvious relationship.

- SQL frontend (and non-dev friendly GUI): Providing an SQL frontend to the blockchain will make it trivial for analysts to query according to their own criteria eg, all transactions in August, with a fee over 700 sat/B with only P2PKH outputs. Or another example could be, volume of transactions to known exchange addresses in the 24 hours before market moves of >10%. Of course that’s only possible if market data is tracked too, but I’ll come on to that.

- Scripting tool box: Almost all explorers do now show payment and signature scripts which is a great start, but there is a lot of information embedded within scripts which is left un-interrogated. Multisig, Data, SegWit, LN, and perhaps soon M.A.S.T outputs, can be traced over time to reveal popular technical trends and behaviour. Wouldn’t it be nice to be able to re-evaluate scripts in a graphical way in the style of an IDE debugger or dry-runner? Perhaps tweak the parameters to see how the transaction would have played out under different circumstances?

- Fee/data/time calculators: Fee calculators are available in all wallet applications however such fees could be more accurate when given a rich meta data set which can use the power of hindsight to anticipate opportunities for sending cheaper than expected transactions.

- Market data: Trade data is of course absent from the blockchain which for the most part records transactions only. The marriage of price, volume, time and region information from the highly liquid crypto’ marketplaces with a queryable blockchain database would really be a step forward. Most exchanges offer free access to their APIs so aggregating this data wholesale isn’t unachievable.

Blockchain.info are leading the pack so far by incorporating a predefined set of chain and market metrics which can be called up and graphed or downloaded. Outside of them the current collection of block explorers is pretty unexciting. Their service is almost essential and very valuable but there is a growing opportunity to enhance these services with rich data analysis tools and this will in turn offer potential revenue generation which can help support the core explorer functionality.

Fortunately, the concept of Block Explorer 2.0 which I’ve been hoping for for so long may be just around the corner. CryptoCompsite promises to do some of the things I’ve talked about above. I haven’t seen a detailed preview yet but I have contacted Charlie Morris, the site’s creator, and he confirmed that he plans to deliver data for a range of projects including, amongst others, these stats:

– Miner selling pressure

– Net spend (after change removed)

– Inflation

– Active network value (market cap with inactive addresses over various time periods

– Comparable valuation metrics

– Identifying regional traffic trends that are speculative and non-speculative

– Address book analysis for wealth distribution, most active, etc. all tracked in real time.

I wish Charlie all the best and hope for this to kick off an era of open economic analysis and research.