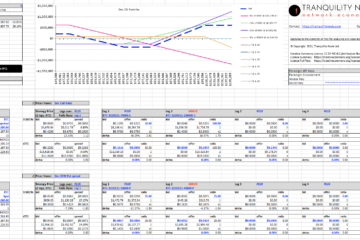

The Options Strategy Aggregator

Tranquility Node are proud to announce a new free tool, this time useful for those using bitcoin options contracts to hedge or speculate on the dollar price of bitcoin. Miners, for example, may wish to hedge against any fall in the price of Bitcoin and use options to ‘presell’ their expected trove at near current prices Speculators may wish to take the other side of that contract to benefit from the alternative outcome. There are Read more…