The Panama Papers leak has dramatically focused the UK public eye on tax avoidance. Although the scale of the offshore tax avoidance industry is surprising the suspects and their methods are perhaps less so. Transparency International writes:

I dare say most people would already have assumed those with financial and political clout had been optimising their arrangements. Why then the drama? Perhaps it is that we now know that everyone knows. Perhaps it is momentum brought by negotiations with tax avoiding multinationals such as Facebook and Google (2). For one reason or another the iron is hot and the collective have the potential to reshape it. Iron takes a lot of energy to heat but quickly cools.

In 2013 David Cameron took position (3) on the tax avoidance schemes of multinational companies stating that it was the moral rather than legal transgressions we must consider, in other words the spirit not the letter of the law. As his personal defence this week though he is choosing the letter of the law as his safe harbour as he defends the right to “make money lawfully”. Cameron’s personal arrangements indeed appear legal and unrelated to public money in all respects other than perhaps a conflict of interest over his leadership on the ‘moral’ question of taxation. More alarming though is the revelation of a global listing of politicians practising embezzlement of public funds (1).

The consensus solution is transparency. UK MPs are publishing their tax details to demonstrate integrity. Note that this is problematic since a successful avoidance scheme will keep certain information out of a tax return. It is otherwise the sensible course of action.

Just as honesty is the best policy, an open financial account is the only defensible foundation for a moral government.

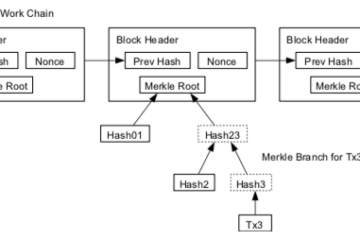

Financial cryptography and its incarnation in blockchaining is perhaps the first opportunity to put financial transparency on industrial scale at the heart of governmental operation. Contrary to initial popular belief, blockchains are primarily mechanisms for transparency rather than privacy. Indeed the decentralisation and public accessibility of Bitcoin depends on the ledger being fully public. Privacy or transparency of identity is left up to the end user to choose between.

Placing a public administration on a blockchain would support transparency. Such a system would involve the administration proving ownership and control of funds and accounts through cryptographic signature. Any money on the system moving to or from unverified accounts would be entirely visible and open to question. To facilitate that a simple (and open source) ‘audit’ program could easily scan the ledger for such activity, a copy of which would be available to every citizen to run at will.

The emerging UK debate surrounding the PM’s private affairs has put the question of individual transparency at the fore. The more important issue is that of public institution transparency. These leaks have revealed the extent of corruption and malpractice of individuals within public representative government and that is best mitigated against by an open public sector financial system.

With a blockchain many things become possible:

- Foremost, transparency from top (eg, allocation of annual budget to the health sector) to bottom (eg, cost for a single antibiotic prescription).

- Embezzlement detection where money is moved to an unexpected or novel location.

- Forensic analysis for fraud whereby should fraud successfully take place any inquiry will have access to a full and accurate (cryptographically verifiable) log of all money movements within the system and to its end points (either a currency exchange to the traditional banking system or other blockchains which may or may not have similar audit features).

- Cost saving automated accounting and allocation of budget (eg, smart contract managed release of pre-agreed monthly amounts for local authority housing maintenance grants) requiring no book reconciliation.

- Opening the door to expert and amateur analysts to carry out public sector research potentially leading to great insights and improvements.

There are also many ways a government could implement such a system. A public decentralised method à la Bitcoin: Allow any person to run a node and incentivise them through crypto-currency payments. Note that this currency does not have to have the deflationary characteristics of Bitcoin should the people and their government prefer inflationary, static or even fluctuating supply decided by elected bodies. Alternatively a more easily controlled semi-centralised system could be set up via the independent central bank. The bank, the government and conceivably some independent specialist institutions elected by and accountable to the people would run nodes each making sure the others were not subverting the rules of the game. The system is still publicly readable and verifiable. Any implementation has pros and cons including choosing a compromise at a point on the scale between control and data veracity. These are discussed at length by many voices in the sector however most would struggle to implement the above features by any other method than blockchain.

Don’t let the momentum caused by the leaks become just a debate on tax law, ask our representatives to open up public money accounting through the most secure and transparent information systems we are fortunate to have at our disposal.

Do you trust transparency machines and the public eye or trust funds and private auditors?

Sources:

(1) http://www.transparency.org.uk/the-panama-papers-what-they-tell-us-why-they-matter-and-what-can-be-done/

(2) http://www.bbc.com/news/business-35724308