James Bullard, CEO of the US St. Louis Federal Reserve Bank gave a welcome and insightful speech this week at Consensus 2018 in New York. Some of the most important things he said in his presentation entitled, “Non-uniform currencies and exchange rate chaos” are repeated here…

“Economic literature says that publicly issued and privately issued currency can co-exist in-equilibrium.”

“Privately issued currencies can facilitate transactions that otherwise would not have happened.”

“Cryptocurrency in my opinion is creating a drift in the US economy towards non-uniform currency – that is a state of affairs that has existed in the past and it has not been popular, and was eventually replaced.”

“Volatile exchange rates in the international stage have not been popular either among policy makers or economists. Cryptocurrency may unwittingly be pushing in the wrong direction in order to solve an important problem which is how best to facilitate market based exchange.”

“Currency is an intrinsically worthless object that has value in equilibrium only because other peopler think it’s going to be taken in future trades.

“It’s possible there’s some technological solution that would make society perfectly happy with multiple currencies – I don’t see anybody working on that, so that’s a possibility. Another possibility is this is is an intractable problem that doesn’t have a solution, so you really do want a uniform currency, I think there are many people out there that think that.“

His speech gives me the opportunity to write about a possible future, or equilibrium, the cryptocurrency world may be moving towards. This shift is facilitated by a technological notion that may in fact be part of the answer to Mr. Bullard’s challenge. That notion is a cross-chain atomic swap, an old idea, but not widely adopted yet as the implementations are still taking shape. These swaps create the ability to trade coins from blockchain to blockchain directly, and their efficiency is likely to have profound effects on the crypto economy.

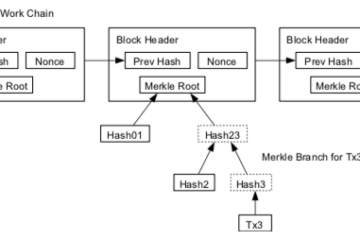

For those not familiar with the term, a cross-chain atomic swap is a means of exchanging one type of cryptocurrency for another, even though they aren’t accounted for on the same blockchain. Traditionally such trades require an exchange to operate as a mediator to ensure that neither the buyer nor seller gets short changed by the other. A trade on an exchange happens in the following steps:

- Deposit: Buyers and sellers deposit their coins to the exchange. For example, sellers will deposit Bitcoin, and buyers will deposit dollars.

- Bids & offers: The buyers and sellers then start adding their price requirements to a central order book run by the exchange and visible to all participants.

- Execution: As soon as any buyer’s and seller’s price requirements match, a deal is struck.

- Clearing: The exchange will take the seller’s Bitcoin, and the buyer’s dollars and move them into the opposing accounts.

- Withdrawal: The buyer is then able to withdraw their new Bitcoins, and the seller their new dollars.

A cross-chain atomic swap achieves the same thing but without the need for a middle man, in fewer steps, more cheaply and faster. A simple smart contract ensures that two parties are able to exchange coin types at an agreed ratio (eg, 1 bitcoin for 100 litecoin) without either being able to short change the other. Users will be able to trade by this method almost as easily as they transact cryptocurrencies with one another now, thus drastically reducing the time and complexity involved in using an exchange. Note that the cross-chain atomic swap on its own only covers the execution, clearing and withdrawal stages of the above process. We will need something along the lines of the lightning network to cover the deposit and bids & offers steps.

Bitcoin has a well defined and narrow raison d’etre which is to be global, online native, and censorship free money. So far it has achieved this without fail since it began, nearly 10 years ago. There are however now many other cryptocurrencies which also aim to be money, just a better kind of money with more features and gizmos with varying degrees of plausibility. These are collectively referred to as altcoins. Alongside that class is another major and growing category, the application coins or appcoins. These generally use some form of blockchain architecture but attempt to achieve all kinds of functionality in some specific domain while incorporating monetary aspects by nature of being blockchains.

Filecoin for example doesn’t primarily aim to be a currency in the day-to-day sense, it is specifically a means to incentivise IPFS nodes to store people’s data well (for a long time, without loss and served at a high bandwidth).

Particl is a peer-to-peer goods and services market place along the lines of eBay. To achieve its goal it issues a dedicated cryptocurrency which is used as the base currency for all transactions (creating a demand for the currency) which can then be used to pay the nodes of the network to keep it reliable and secure.

Anyone wanting to interact with these systems will need at some point to be sending or receiving this application specific currency. If they want to buy data storage for example in daily batches they will have to perform a daily purchase via an exchange to get the coins they need. To save effort, they may decide to purchase a larger amount of coins on a monthly or quarterly basis instead. They now however are carrying exchange rate risk over that period of time which could significantly affect their ability to buy storage when they need it. To clarify that point, There is an exchange rate between USD (or BTC) and Filecoin, and then an internal ‘exchange rate’ of storage bytes for Filecoins which fluctuates according to supply and demand. It is this later rate which a coin holder with the intention of spending, will be exposed to.

A problem with application specific currencies is that they are likely to always have volatile exchange rates because very few applications (probably none) are as universal as a general currency like Bitcoin and therefore will be used by smaller demographics. Blockchain designers, at least implicitly, know this and in fact design their system according to this trait as the market value of the currency is linked to the success of the application and this works to incentivise participation. This is akin to a company issuing stock options to its staff to incentivise them to improve the value of the company.

This leaves users of these systems with a dilemma, hold a universal currency which is an excellent store of value and only exchange it into any application coin when needed, or hold a portfolio of smaller and more volatile application coins which they expect to need in the near future. I believe this is exactly the problem Mr. Bullard had in mind when he said, “Cryptocurrency in my opinion, is creating a drift in the US economy towards non-uniform currency – that is a state of affairs that has existed in the past and it has not been popular, and was eventually replaced.”

˙ . ˙ ˙ . . ˙ ˙ ˙ ˙ . . . . ˙ ˙ ˙ ˙ ˙ ˙ ˙ ˙ . . . . ˙ ˙ ˙ ˙ . . ˙ ˙ . ˙

The friction and cost of exchange is relatively high at the moment. Decentralised application (DApp) developers and entrepreneurs see opportunity in the feedback loop engendered in the defined ecosystems they create and in good cases so far mostly everybody wins as the valuations climb. As these systems mature and embed themselves into every day life rather than just being exciting speculative investments though the dilemma described above will become more pressing. There is a significant cognitive load associated with staying on top of the market health of all the different application coins you need to use, such as… on-line shopping coin, supermarket coin, data storage coin, electricity coin, news coin, mobile phone credit coin, video streaming coin, social media coin etc, etc. In a decentralised ecosystem investors and consumers become the same person, but this can have unintended consequences much like making your customers pay for your services using only shares of your company. If they expect the company to do well, they will hoard the shares and not buy the services, thus starving the company of income.

Now, imagine this world but with frictionless interchange of value across these otherwise distinct systems, brought about by widespread adoption of cross-chain atomic swaps. It would be easy for anyone to keep their money in Bitcoin, and simply send & convert it over to their given application any time it is needed. In a sense, the Babel Fish of money. They avoid cognitive load and get the assurance of having their savings in the most secure financial system in existence, a very compelling proposition.

This poses a problem for blockchain designers. If users are less interested in the valuation or success of any given coin the incentive structure of the system may need to be externalised.

Bitcoin runs a proof-of-work consensus system meaning it externalises its security to a community of ‘miners’ who competitively expend vast amounts of electricity in computations designed to ensure the ledger cannot be re-written by any one else, for the chance of being rewarded with newly minted Bitcoins. If other systems struggle to maintain demand for their coins then they will certainly struggle to maintain a mining community of their own.

Side chains, drive chains and merged mining schemes represent a solution for DApps, enabling them to have a blockchain customised to their app, but adopt the mining community and currency unit of Bitcoin.

If an app really does need it’s own free floating coin then it will likely implement a proof-of-stake consensus model which incentivises the hoarding of coins in order to earn a rate of return from them.

It seems likely that DApps will move to integrate with a dominant general currency and infrastructure such as Bitcoin or face competing with it head on through a proof-of-stake scheme. In other words, the brave strategy: if you can’t join them, beat them!

Cross-chain atomic swap technology could therefore serve to rationalise the crypto economy and DApp ecosystem around a universal cryptocurrency. By that same token (excuse the pun), proof-of-work would become relevant only to contenders of the title of the universal crypto currency.