Cryptocurrencies are new and volatile. This wild volatility has repeatedly raised the question as to whether they should be more stable and how stability could be achieved. A stable coin is a cryptocurrency which maintains a stable market valuation over time and doesn’t shoot up and down as Bitcoin currently does for example. Valuation volatility in a money harms its ability to be a currency as it becomes difficult for anyone to know how much they will be able to buy with it in the future. If, therefore, cryptocurrencies are to become true currencies then should we try to make their valuations stable over time, and if so, how? It is important that we understand where stability comes from and that it generally requires vast scale unless we are willing to accept some important limitations and risks. Let’s navigate this field by first defining what we mean by stability, learning from the ways in which money has achieved stability in the past and then determining if and how stability can be achieved in cryptocurrency.

Defining stability

Any market price varies, all market prices vary. Population sizes vary, supply, demand, business cycles all vary, constantly. Aside from the speed of light, there isn’t much to cling on to in this ever expanding universe. With absolute stability out of the window then, we turn to relative stability – the measure of one asset’s value against another asset’s value.

In ye olde days, it was fashionable to peg one’s currencies to gold and call the movement the gold standard. Any gold backed currency would trade in line with the value of gold and by extension any other gold backed currency. The US Dollar has replaced gold as the global reference rate of value, and to be considered stable now an asset must have low volatility relative to the dollar.

Is stability with the dollar the end game though? Is that the point?

If you pause for a moment you’ll probably venture that, economically speaking, purchasing power is the ultimate in stability metrics. That is, the value of a unit of currency versus the amount of some important commodity, like beer. The USD does a decent enough job of preserving purchasing power but, mind you, has devalued 95% over the past 100 years.

Stable cryptocurrencies

Bitcoin: Some argue that if Bitcoin wants to be a cryptocurrency it has failed, because any money that wants to become currency must first become stable.

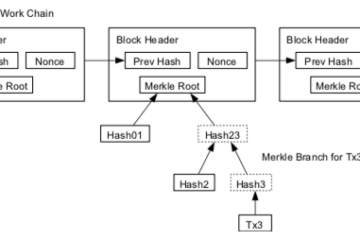

Bitcoin is indeed aiming to become currency but it is achieving this via a never before tried route – decentralised digital ledger money. Its economic design has been inspired by gold. Bitcoin therefore, like gold, best fits in the class of money known as commodity money. There have been a few long-lasting examples of commodity money such as gold and salt but before Bitcoin, none in the form bits and bytes. The best shot Bitcoin has of becoming a reliable preserve of purchasing power is to build popularity through growth, a necessarily volatile activity and a very long road.

Now, gold is pretty unstable itself when measured against the dollar. In the year 2000 it was as low as $370 per ounce, and today we’re close to $1,300 (godl, anyone?). Gold purchasing power on the other hand is a little more stable… a little. Given that gold has existed since before life on Earth it has something of a head start and can teach us what lies ahead for Bitcoin. Bitcoin may never be more stable than gold in our lifetimes, but if it turns out to be more useful thanks to its intangible nature then perhaps it will be more widely adopted, used and… bigger and more stable than gold. Perhaps that seems too wild a thought, if so, just accept it as a thought experiment for the purposes of analysing the goals of stablecoins.

While we wait for cryptocurrencies to become the proverbial oil tanker sailing unwaveringly through the rough seas of global commerce, is there anything we can use as a stable stopgap in the mean time? To answer that, we should consider the use cases for crypto-stability.

Speculative trading: Most people involved in cryptocurrencies today are speculators and as such they are risking their purchasing power over time on the roller coaster of volatility. They would like something stable to hold on to when prices fall, then jump back in when prices rise. USD would work, but there is a problem with that. The crypto-exchange industry is cleaved in two. There are a few exchanges which offer USD or other fiat funding of trades but typically only against the top 2-5 cryptocurrencies. The rest of the exchanges offer zillions of alt-coins but have no fiat funding options due to the overheads and complexities of partnering with regulated banks. As a result of this industry quirk, a niche has opened up for a stable cryptocurrency traders can easily switch into when markets turn bearish.

Cryptocurrency: Bitcoin and it’s siblings have the advantage of working around the clock, beyond borders, without permission and in an uncensorable way. An excellent form of money to buy anything from groceries to gizmos if it wasn’t for the pesky price volatility. Many would like to bypass the long journey ahead of Bitcoin as a commodity money and make it stable… right now dammit!

Savings account: Being one’s own bank may be a great way to ensure one’s life savings outlive any particular financial product, institution or even nation. Being able to make regular purchases and know that those coins are safe from theft, seizure and purchasing power erosion will appeal to at least a subset of people.

Stability mechanisms

Let’s not try to innovate here, at least for a moment. Nation states and central banks have pondered stability for a long time and have done the hard work already so we’ll quickly recap their approaches. These break down into two categories, passive and active stability mechanisms.

Passive

Representational money: The central bank takes in gold bullion, stores it in an extremely secure vault, and issues credit notes to the depositors. These credit notes are fungible bearer instruments, meaning they don’t have the depositors name on them, don’t have any specific expiry date and are identical to all other credit notes issued by that bank – in other words, cash. Holders of these notes can do two things with them, either use them as a means of exchange (currency) or redeem them with the central bank in order to obtain back an equivalent amount of gold bullion. It is the redemption function which is key to the value peg to gold. Because any holder can, at any time, redeem their note then the note itself becomes as valuable as the gold it can be converted into.

Can cryptocurrencies adopt this method? Yes. See Royal Mint Gold and Tether for two examples (note that Tether holds USD in a bank account, rather than gold in a vault). There is one teeny-tiny caveat to this method for any privately issued asset backed money and especially for a cryptocurrency, and that is trust. Holders of notes, coins or tokens must put their faith in the issuer to store the assets and to issue only the same amount of tokens as they have assets in the vault. They also must weigh the risk that even if the issuer may be fully trusted a powerful third party may cause disruption to that vault. This is especially a concern for cryptocurrencies as they are designed to be free from single points of failure. If they are not then they are likely not to have the permissionless and uncensorable nature we were looking for in the first place. Speculative traders may be willing to accept these caveats as typically they would only be invested in the stable coin for brief periods of time, any longer and it becomes worth it to move into USD, if USD is the benchmark of stability being sought. Currency users may choose to keep their monthly budget in the stable coin, something like a current account giving them stability for a portion of their assets, diverting their long term savings elsewhere. Savers would be comparing the stable coin proposition to other competing forms of long term savings product, all of which have the same kind of issuer trust considerations – they would have to weigh up the individual pros and cons of the features offered by each option.

Tether does very well for traders at the moment but comes with huge public concern for the integrity of the reserve as details are kept secret. Royal Mint Gold is backed by a world famous public institution who has previously had Isaac Newton as chief and has been ticking over for more than a millennium. If you’re going to trust any institution with your gold, this is the one to go for.

In summary, if stability relative to some reference asset is your objective and you are able to trust the issuer, then the central bank representational money model is simple, tried, tested, understood and absolutely stable.

Active

Fiat money pegged to foreign currency: The Hong Kong Dollar and Swiss Franc have both historically pegged their values to that of the US dollar. They, and others like them, don’t however do this by means of simply storing an equivalent amount of USD in their vault and issuing redeemable notes. Central banks and their associated governments like to enjoy the profits of seigniorage. That is the the difference between the cost of issuance (in simple terms, the paper and printing) and the much larger value written on the note. The trick here is to decree that the currency value is stable versus the USD then modulate money market interest rates to drive demand up and down for that note accordingly. If demand goes up, the value of the note would go up versus the USD -> drop the interest rates and demand will subside for the note restoring the peg, and vice versa. Interest rates aren’t infinitely flexible though, it’s hard (and unpopular) to push them below zero, and extremely unpopular to push them much above single digits. Central banks therefore have a backup tool which is to inflate and deflate the supply of notes in circulation. They tend to do this by buying up notes from the market in exchange for USD, or selling new notes for USD and as a consequence they in fact do tend to keep a stock pile of USD in their vault. This stock pile is typically not going to be enough to fully back the notes circulating value though as it is only part of the stability mechanism. Both SFR and HKD have experienced shocks where they decouple from their USD peg to some degree and HKD is sweating to maintain its ratio as we speak.

Fiat money pegged to consumer price inflation: USD, GBP, EUR for instance don’t peg to a foreign currency but instead aim for stability versus purchasing power over goods. They use a similar set of tools as described above, namely the inflation and deflation of the supply of notes through money market activity and the adjustment of lending rates, collectively known as monetary policy. They have one more trick up their sleeves which is having a government which is able to modify its tax collection and expenditure rates (fiscal policy). By these means they can control supply and demand for the currency directly through the printing press and indirectly through the public economy.

Can cryptocurrencies adopt this method? Maybe. Basecoin, Saga, Nubits and DAI use elements of these designs. They are actively managed in that they make observations to a given peg and react accordingly by issuing or re-purchasing tokens. These pegging effects are limited in just the same way as fiat pegs are, and the centralisation risks of the reserved asset persist.

One bonus for cryptocurrency versions of active management is that they may be less likely to fail for the reasons of re-purposing of monetary and fiscal policy. Governments have been known to reach for the printing press lever to fund wars and deflate unwieldy national debt with the inevitable consequence that the prices of goods go up. It may turn out that cryptocurrency stablecoin projects have an advantage over national currencies in that their mechanisms can be algorithmic and decentralised, thus fixed to a given purpose and difficult to co-opt for other intentions.

Inflation and deflation of the supply of tokens by a decentralised cryptocurrency may seem hard to achieve. Who is going to issue and repurchase as required? Especially if the issuing body isn’t backed by reserves of some other currency. The answer is all the users do. Inflation can be achieved in the same way Bitcoin inflates its supply through a mining subsidy (12.5 new BTC per block awarded to the lucky miner, ‘trickle down’). Deflation is trickier but still possible in a similar way. Set a global parameter (much like mining difficulty works as a global parameter) which is defined according to the current currency to peg value ratio. Existing monetary values, when spent, must be multiplied in series by the factor of each subsequent block up to the spending block. For example: 1.367 coins * 99.9% * 99.9% * 99.8% * 99.9% * 100.04% * 100.08% * 98.2% = 1.337 Coins in “today’s money”. Price deflation/inflation happens as a consequence.

We can even start experimenting with ideas like algorithmic helicopter money and universal basic income.

In summary, active management is far more complex and less stable than representational tokens but with some potential advantages over similar mechanisms in national fiat. If we accept the risks and complexity then we can produce some highly exotic mechanisms in this category which may suit niche use cases.

Conclusion

In conclusion, the major theme is that stability is only easy to produce when we simply import the stability of some other asset, thus creating a proxy coin, or wrapper, and then we must question whether the proxy is better than the original (the answer can be a yes). In all other cases there are risks and costs involved, stability is always relative and difficult to manufacture unless we work at huge scale. While we wait for large scale decentralised cryptocurrency adoption we use stable coins but keep in mind their inevitable limitations. StableCoins should not be put in the same risk basket as cryptocurrencies, they are very different animals and have their own distinct risk characteristics and features, much more in line with the financial products banking institutions have been creating for decades but with a new infrastructure twist.