Welcome to the first edition of our periodical for analysis of the most interesting recent events from the network economies sector. The aim is to be selective rather than comprehensive, apply a critical eye and to draw attention to projects and ideas which will have a signifiant and positive influence on the future.

Contents

- Twitter and Bitcoin

- Bear market damage to the corporates

- Bitmain’s new mine, 200k ASICs deep

- BTC price spike

- Veriblock IEO

- Coda

- MaidSafe

Twitter and Bitcoin

The CEO of Twitter, Jack Dorsey is very much a ‘Bitcoin not blockchain’ fellow and furthermore a ‘Bitcoin not cyptocurrency’ one. Dorsey founded the publicly listed payments company Square which has a product named CashApp used for making small smartphone based payments to usernames rather than bank account details. CashApp enabled a Bitcoin brokerage service at the start of 2018 with which customers can buy, sell and store bitcoin and also plans to integrate the Lightning Network. The linked debit card makes it very easy to live day to day purely with a bitcoin balance. Of course these bitcoins are looked after on the customer’s behalf over at CashApp HQ – this is not an idealistic business. Dorsey however has recently demonstrated sensitivity to to the cultural ideals of Bitcoin (open source, self sovereign money, privacy, etc) by announcing that he wants to sponsor some Bitcoin Core developers to carry on doing what they do:

It’s probably fair to say that most cryptocurrency businesses do not donate or contribute to the open source efforts on which their businesses are founded, though a few do. There tends to be a divide between the entrepreneurial mindset which sees the business opportunity and the social endeavour of the developers and activists. The SegWit2X project was a fine example of the heated tensions that erupt when these two sides clash.

Dorsey has managed to embrace both the business and social movements of the community. This rare skill puts him and his companies in good stead to become more dominant and potentially expand the sector as a whole. If Lightning Network is somehow embedded in to Twitter the world will notice.

Perhaps though we should be worried that a powerful figure is attempting to exert personal control over the development of Bitcoin. Bitcoin’s development model is fairly well secured against these sorts of attacks through the orderly BIP (Bitcoin Improvement Proposal) so no need for alarm, the community will remain vigilant as ever.

Bear market damage to the corporates

At the time of putting this letter together the bear market had been with us for over a year. Just in the last few days there has been a dramatic uptick in prices and volumes so perhaps a new story is emerging, more on that later. Until that moment though the evidence of revenue starvation at exchanges, blockchain software houses and other firms had been piling up. Consensys, the New York consultancy and software development house focused on Ethereum opted for a dramatic restructure at the end of 2018. The pain didn’t end, here are some examples from the past couple of months:

- Liqui network shuts up shop citing ‘lack of liquidity‘

- Crypto Facilities offering new market making incentives to boost liquidity

- Crypto Facilities sold to Kraken. Perhaps not such bearish news but consolidation in the exchange sector is indicative of risk aversion leading to strengthening of the dominant brands and weakening of the smaller ones. Kraken is opportunistically buying a stake in the derivatives market in time for the next wave of interest.

- BitThumb lays off 50% of staff

- Bitmain fails to IPO

- R3 co-founder leaves. Reportedly a result of difference of opinion on strategy, but if revenues were higher it seems unlikely that such a difference of opinion would have occurred.

- Digital Asset’s CEO, Blythe Masters leaves

- Digital Asset’s Europe Head leaves

Bitmain’s new mine, 200k ASICs deep

Following its failed IPO and slight change of management, Bitmain has announced that it’s going back into mining… for itself. In case you missed the headline, the plan is to deploy 200,000 sha-256 ASIC units in locations which benefit from the excess electricity produced by hydro-power stations during the Chinese summer rainy season. They clearly see this as a more profitable enterprise than selling the hardware which they could easily choose to do.

The picture is clouded by the complexities of Bitmain’s restricted supply chain and alleged debt owed to chip fabricators however this remains a good case study of the role of mining equipment firms. Should they mine or should they supply? Let’s hypothesise that in bear markets, like now, it is better to mine and in bull markets, like 2017’s, it is better to supply. If that holds true then if we project a future where bitcoin is a multi-trillion dollar asset embedded in the global economy then volatility and margins will be low, similar to the current bear market. Mining may end up profitable only to firms which can produce their own hardware. That may not even mean specialists such as Bitmain anymore but subsidiaries of Samsung, TSMC, Intel etc.

Economies of scale are the enemy of decentralisation. Bitcoin and other network economies suffer if authority begins to coalesce. Keep an eye out for innovations which push towards genuine commoditisation of mining hardware, this will precipitate shifts in the political base of these systems. RAM is often touted as the ultimate in commoditised hardware though RAM heavy mining algorithms (eg scrypt, ethash, equihash) haven’t yet managed to exploit this to very great effect.

Bitmain’s plan in numbers:

200,000 units x 1300 watts = 260m watts = 6,240,000 kWh/day.

6,240,000 kWh/day * $0.037 per kWh = $230,880 daily electricity bill (estimated)

~$7m monthly electricity bill

Let’s assume the article below has an accurate estimate for the sales value of the hardware of $80m. Samson Mow estimates Bitmain to have had to sell their recent S15 model at a ~30% loss due to it being an uncompetitive design. Let’s then conservatively set their sales value to be roughly a breakeven for Bitmain, given the mix of models they are reportedly deploying (S9i/j, S11, S15). The choice then seems obvious, face a zero profit move by selling the rapidly depreciating hardware now, or gamble the $80m cost plus $7m a month on mining from May to September (the rainy season). This equates to an $80m + ($7m x 5 months) = $115m gamble.

An S9 can make about $1 profit per day (based on recent average data) so let’s generously say $1.50 for their mixed deployment which includes some more efficient hardware…

200,000 units * $1.50 per day = $9,000,000 per month profit

$9m * 5 months = $45m

That isn’t enough to offset the $80m cost of hardware manufacture so Bitmain may have to mine into the dry season when power will go up to around $0.05 per kWh.

The risk they are taking is on the price of Bitcoin going up, this is a fairly sensible bet given that their business is massively exposed to that risk already. Tranquility Node’s own mine is up for sale, no time-wasters! We will publish the results of a year long mining experiment soon but the data collected supports the decision Bitmain have had to make, to some degree.

BTC price spike

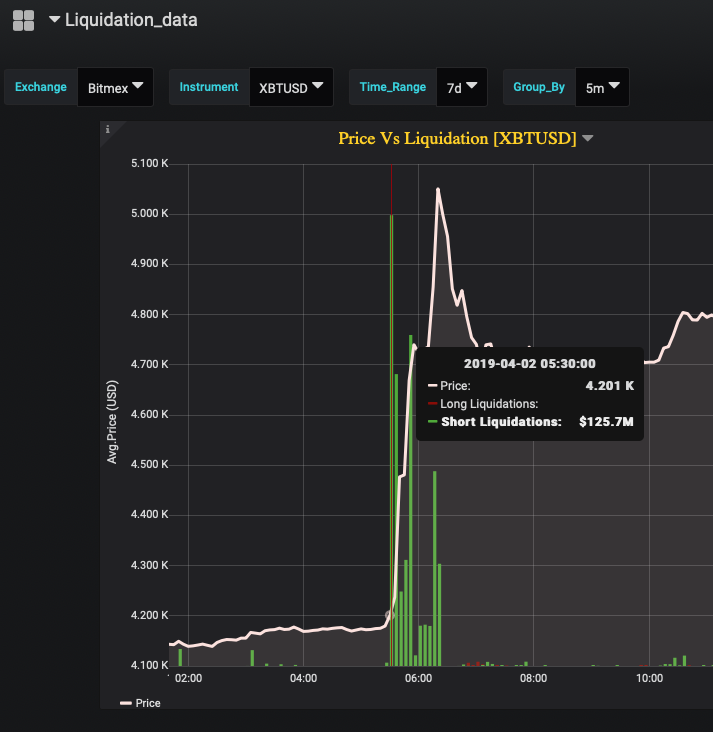

Bitcoin’s price jumped on the 2nd April from $4200 to $5100 before settling to around $4800 and then has gradually increased to about $5000 in the following couple of days. There is plenty of commentary online but in short there isn’t any clear catalyst for the move. One report states that 20,000 bitcoins were bought across three spot exchanges simultaneously in coordinated fashion. The social media mood for bitcoin has been turning gradually more bullish for a while as people expect the bears to be ‘exhausted’ and the bottom to have been found. It is possible that one wealthy punter just decided to jump in now before anyone else does. Given that there is a very active OTC market which would have facilitated this order much more cheaply, it seems unlikely.

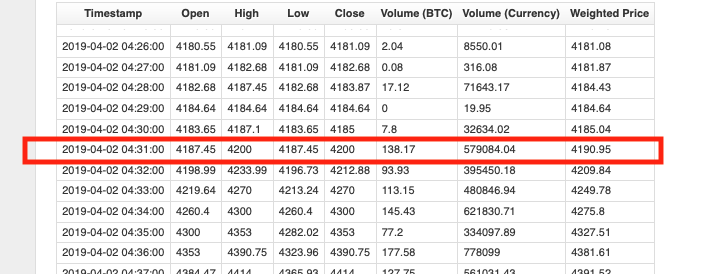

Simultaneous to this buying of BTC spot, a large short squeeze was taking place on the futures platform, BitMEX. Positions were being automatically closed out and covered ‘at market’. It would make most sense that the short squeeze was the catalyst and BitMEX’s auto-deleverage tool was behind the costly algorithmic buying spree, which then triggered a rapid feedback loop. The fist bulk buy on Bitstamp was at 04:31am GMT on the 2nd April:

While data from BitMEX suggests the first big closeout was 04:30 GMT (note that the times on this chart are in GMT+1) :

These are not sufficiently accurate data feeds to be conclusive but it seems we can’t rule out BitMEX being the cause and the spot market being the effect as it looks like it happened one minute earlier.

Who was it that said derivatives reduce market volatility?

Veriblock IEO

Echos of the 2017 ICO craze are arriving in the form of Initial Exchange Offerings. Almost exactly the same idea as ICOs but with exchanges doing most of the work. This room of people, apparently buying up the limited access to the sale, reminds me of Glastonbury ticket touts – maybe the ICO/IEO world needs to call Michael and Emily Eavis for advice. The host exchange, Bittrex reported that the listing sold out in 10seconds.

Coda

Coda is a new blockchain protocol still in development. The designers have taken the cryptography developed originally for ZCash, known as “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge”, or zk-SNARK for short, and reworked it to offer astonishing levels of network scalability instead of high privacy. Zk-SNARKs were developed as a means of encrypting transaction data on the public distributed ledger but remaining mathematically homomorphic meaning miners, nodes and auditors can still verify the integrity of transactions with the network’s rules set (i.e. no coins issued out of thin air, no double spending, etc). While that is a boon for monetary fungibility it is horrible for scalability, requiring roughly 10x the data footprint of an unencrypted blockchain like Bitcoin’s.

Coda focuses the power of SNARK technique on replacing the blockchain with a proof of the blockchain which can in effect take its place entirely. As I’ve said many times before, the bad thing about blockchain… is the blockchain. Any cryptocurrency project which diminishes the ball and chain of the ever growing ledger has achieved something very impressive. Coda would replace the Blockhain with a proof of fixed size, just 22kB, small enough to fit on basically any digital device. This proof never grows in size. This project is well worth watching… however, in the last few days VCs have injected $15m into the development. Having financially motivated backers awaiting a return means they need shares in the protocol, the protocol which is entirely focused on decentralisation. Decentralisation is not a concept compatible with shareholdings. Grin, the MimbleWimble implementation, has been self funded taking in no investment capital so bootstrapping of decentralised networks can still be achieved reasonably well in a post Bitcoin world.

MaidSafe

We’ve been mega fans of MaidSafe and their SAFENetwork project for years. This is the original contender to the throne of ‘cryptocurrency without blockchain’ but has the potential to be much more than that even. Ethereum is often called ambitious, SAFENetwork makes it look like a modest trifle. While their team is high calibre and their output is continuous and of good quality they still have a long way to go on their own roadmap before the fundamental features are functional in the wild. One year ago their COO disclosed that they had funding for about 2 years and that should be enough to get them into a sustainable revenue generating state. With one year left we still have almost all the major milestones yet to be completed. The world has so much to gain from the success of this project – it may be time to seek out patronage from the generous crypto-wealthy.

Alternatively, they might want to re-consider paring down the feature list for their first production launch. User friendly NAT traversal and smartphone support are two time consuming developments which are non-essential to get to a self sufficient income generation stage. While these two example features have obvious benefits they aren’t helping with the timeline. Once a functionally minimal production network is live, the native cryptocurrency would likely appreciate in value offering a lifeline to the developers. Perhaps more important though would be the start of voluntary engagement of external developers. As soon as the fundamental features are live and serving a purpose (file storage and cryptocurrency support) MaidSafe will no longer have to solve every problem and build every solution – the world will take ownership.

Despite the above project management critique, the SAFENetwork idea is game changing for global data, the web, ubiquitous archival of information, real time communications, surveillance capitalism and more.

Tranquility Node hosts the London meetup for the SAFENetwork project – if your organisation would be interested in housing the 3 hour monthly event please drop us a line.