This article was first published by the one and only Coinscrum, and can be viewed on their site, here.

We’re early adopters, which must mean the tech doesn’t do what we want it to do yet. Bitcoin isn’t a currency… yet, security tokens don’t provide any new liquidity or features… yet and decentralised autonomous organisations don’t control any significant assets or have any structural or political influence on society… yet. The chips being very much up in the air then we all must be optimistic visionaries, high on the fumes of DMT (distributed meth technology). Do we all see the same future though? It seems unlikely. Having obsessed about and worked within the cryptocurrency sector for about 35 years now I have some opinions. The following is where I see the chips falling on the 22nd May 2049, exactly 30 years from now…

The European Union tokenised, Britain sold at the bottom and bought back at the top during the great nation-state token boom of 2032. Only kidding – that won’t happen… in the next 30 years.

In the beginning there was the Bitcoin,

and the Bitcoin was blockchain.

Blockchain’s killer app is the gift of political decentralisation of the control of information, underpinned by intrinsic monetary incentives. The last time something like this appeared was the dawn of the corporation – a legal construct with rights to exist, own assets, receive income and yet not have to be reliant on any single natural person for any part of it and indeed potentially far outlive the people associated with it. The modern world would be unrecognisable without the the idea of the corporation. 30 years into the future isn’t so far that we need the help of sci-fi futurologists to help paint the picture though – the building blocks, technology and trends are already here, along with a lot of noise to filter out.

Money:

The Bitcoin network will be the basis for all that is crypto’, even the regulated, legal and corporate things. Just like the open internet subsumed all non-standard intranets and other variants of networks of networks, Bitcoin will entrench into the fabric of its own technological sector and in parallel into all of the applications and use cases that this tech eventually touches. Institutions, governments and multi-nationals will not only adopt Bitcoin itself but also insist on any blockchain-like systems being ultimately bound up in the security of Bitcoin too, because independent platforms are simply too vulnerable. How and why would this be the case though – it is a far fetched view given the current mainstream coolness toward Bitcoin. Over the next few years the ongoing Cambrian explosion of blockchain and related tech will both demonstrate wonderful, novel and unique use cases on the world stage (e.g. digital gold, DAO’s, decentralised prediction markets, token financial engineering), but also terrible failures, implosions and crises. Economic collapses will occur as a result of smart contract facilitated systemic risks so complex and layered we’ll only be able to speculate as to what went wrong, making the 2008 MBS/CDO subprime fiasco look like a clerical error. Darwinian competition of ideas will push the technology into every social niche, and like the tree of life, the bulk of the branches stop at dead ends, leaving a much smaller set of impressively successful experiments as the long and enduring branches covered in berries and flowers. Those dead branches don’t end gracefully there is sadly a lot of pain there. I’ll be specific about how Bitcoin gets to become so dominant…

- Incentives:

If you don’t know already, a Shelling point is a simple aspect of game theory which exists where group behaviour becomes predictable around the existence of that conceptual point. Two cyclists about to meet head on down a narrow alley will likely be fine thanks to the Shelling point of ‘driving on the left’ which is habitual for both riders. Even though they have never met before and don’t communicate, they and all other cyclists meeting on narrow paths will almost always pass without injury. Put up a reasonable flag or rule for a niche and when people encounter that niche again when there is something at stake, they will almost always revert to that precedent flag to silently resolve the decision in a mutually beneficial way. Bitcoin is the Shelling point for cryptocurrency as money. Bitcoin survives not because it is advanced tech or has more (or less) features than some other platform, it is simply the default by nature of being such an elegant and purist Shelling point. As it grows in value people invest more, tell their friends and the growth curve continues – like a virtuous Ponzi scheme. Once a good chunk of the population have a good chunk of their savings in Bitcoin, they don’t want Bitcoin Cash, Ethereum, TRON, Cardano or any other fancy newcomer to usurp Bitcoin thank-you-very-much. This is neo-communism, not capitalism where we don’t care if Amazon beats Walmart because we still get our groceries delivered either way. Only Amazon stock holders care and in Bitcoin everyone using it is a stock holder – what’s more, everyone who needs the unique properties of crypto-money over the long term will gravitate to the Shelling point that is Bitcoin, anticipating that others will do the same. This is a controversial statement in cypherpunk circles so I’ll reinforce it with the notion that Bitcoin belongs to no one, and therefore belongs to everyone, not just those who currently own coins. Everyone is able to own a copy of the ledger and use it for their own benefit. Everyone can contribute hashing power or operate some business which derives value from the existence of Bitcoin. Bitcoin is comparable to common land and although it contains and supports various rampant capitalistic enterprises, such as mining, it itself is a common asset. A common asset available to all, without qualification or even identification, and therefore what I would call a neo-communist construct.

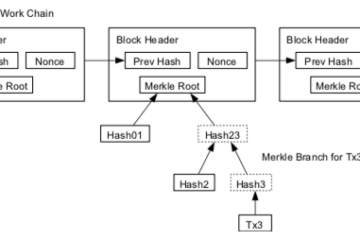

- SHA-256:

As you are probably aware, Bitcoin is perpetuated by a game of chance called mining which proceeds in rounds, each a few minutes long and with some money to be won at the end. This game requires all participants to plug random numbers into a numerical transformation called SHA-256 and whoever gets a sufficiently low number out first gets to shout, “BINGO!” and win the round. Other networks have been made which also use SHA-256 and Bitcoin has even forked many times into incompatible offshoots which carry forward this same game. SHA-256 miners therefore have a daily choice whether to mine Bitcoin or some variant. We have already seen at least one mining war in this community and when big money is at stake conflicts intensify. If any non-Bitcoin SHA-256 based chain were to become significantly valuable, an arbitrage opportunity opens up for miners to short the new asset then undermine its chain – it can become a collective game where a dominant side can win a little and thus become more dominant as more miners join the winning team to exploit the opportunity until there is no value left in the other chain and it withers. Given the Shelling point nature of Bitcoin, the miners will always tend to favour it as their investment depends on not rocking the boat.

- ASICs and energy:

Profits from mining have so far largely accumulated at the companies producing mining equipment, known as ASICs (a.k.a shovels). Manufacturers have been able to squeeze buyers with super high markups justified by the buyers who cross their fingers and bet on bubble economics continuing. Eventually these profits will be competed down to a narrow margin, commoditising ASIC hardware. Once commoditised it will be virtually impossible for any significant innovation step change to occur which will lead to a very predictable and stable market for miners supporting Bitcoin, in turn leading to higher levels of faith in Bitcoin’s ability to remain decentralised and maintain its integrity. Commoditisation can only happen over a long period of time and with sufficiently high profits being made by equipment manufacturers. Other algorithms will struggle to commoditise. Commoditisation also helps the decentralisation of mining by reducing the effects of economies of scale. The largest buyers in the market can negotiate much better deals when the manufacturers are charging high markups as standard but when the markups are paper thin, everyone buys at the same price, there are no bargains to be had. The battle for competitive edge will shift focus away from hardware and towards the consumption of as much of the cheapest energy available – eventually that reaches an optimum point too and the global mining capacity growth begins to flatten out and stabilise somewhat or at least track the development of cheaper sources of energy.

- Appcoins and utility tokens:

Some predict a future where every service has its own currency. This is something like a logical expansion of the idea of loyalty points, air miles and retail vouchers – perhaps along the lines of the private money economy that Hayek loved. The ICO craze was clear evidence that there is interest in heading down this path, Binance Coin (BNB) being a prime example. BNB derives its value from being redeemable for Binance’s cryptocurrency exchange services – in other words, a retail voucher. There is currently quite high friction for moving between crypto assets, involving the use of wallet transfers, exchanges accounts, trade execution and data intensive tax accounting. That friction, plus an attractive dose of speculative trading is what has caused most BNB owners to hold it and buy it in the first place. In a world where coin exchange friction is reduced to a button press (think atomic swaps and decentralised exchange protocols wrapped up into a Steve Jobs GUI) why would any normal user want to store any of their wealth in such an appcoin? Appcoins are designed to work in the interests of the app or its issuer, not in the interests of the holders and thus their valuations are smaller and more volatile than bitcoin can be. Where bitcoin to appcoin conversion is fast, seamless and efficient everyone can store their wealth in bitcoin and convert into an appcoin only at the point of purchasing a service, thus immediately buying and then redeeming the coin for that service. Issuers will soon find themselves holding all of the coins they issued and thus having to price their service in Bitcoin anyway. This thought experiment leads to the conclusion that there isn’t much point in issuing or speculating on such a coin in the first place.

Over the next 30 years I’m sure we will see scenarios unfold which look very similar to the above and by nature of its network effects and unbeatable economic security properties Bitcoin will become a de-facto standard for money. Not the only money but the international reference of it, acceptable in settling any debt anywhere in the world.

Securities:

Financial assets like stocks, bonds, promissory notes, certificates of deposit and derivative contracts are essentially just information and logic. They exist as applications on top of the shared infrastructure of the legal system. Almost by definition securities represent risk against some other party and are subject to some level of governmental regulation. Decentralising securities might seem like an oxymoron so why would anyone want to put them on a blockchain let alone Bitcoin? For these reasons we may not see a rapid shift of traditional securities over to crypto equivalents. Where security tokens and smart derivatives will excel however will be in providing the features of securities such as equity, debt, hedging and leverage to strange chimera entities we don’t yet have jargon for. These entities will be part start-up, part non-profit organisation, part decentralised autonomous organisation and part things I can’t imagine. They will however become commonplace and mundane. They will need funding, they will exist only on blockchain platforms or similar and they will be able to fundraise, incentivise and gain stakeholders only through token offerings. There will of course be human backers, staff and employees in some form who need that capital – this isn’t quite the realm of self owned, self driving taxis. As such, securities regulation will apply, people will be accountable but the instruments will be weird and wonderful and the organisations will be novel and far more ‘programmable’ than your classic PLC or Inc. These companies will be disruptive to the old school, obsoleting businesses and products, but also securities marketplaces as they go. For the traditional corporates and institutions to survive in the token market they will have to remodel and adopt new principles, shedding their old skin.

As I mentioned above, everything crypto will link back to Bitcoin. Securities always involve future cash flows, for example bond principal paid back at maturity, dividends paid out to stock holders and settlements of options and futures contracts. In a security on a blockchain where will this capital come from, how will it be made available to the smart contract and how do we know where to pay it to? Dollar backed tokens can fix some of these problems, for instance, they can be paid directly and automatically to all addresses currently holding the associated security token since the dollar tokens are hosted on the same system as the security token. If the security token world was simply the traditional securities market transplanted to this new tech then that’s most likely what would happen, but as already discussed I don’t anticipate that being the dominant scenario. The entities I struggled to imagine who do dominate the new world of securities token markets will have blockchain so deep in their cores that Bitcoin will likely be their base currency. Revenue, overheads and profits will all be in bitcoin and thus can be controlled by, automated and sensibly managed under the control of smart contract based equity, debt and hybrid instruments linked to the all digital balance sheet of that entity. Revenues and overheads are accounted for on ledger leaving objective profits which can flow seamlessly into the dividend function of the same smart ledger.

Perhaps the Bitcoin blockchain remains insufficiently flexible to host the complexity of these new forms of economic entity and we do need the brightly coloured world of Ethereum. I still see that as compatible with the overall vision. Ethereum has always been a scalability long shot and the community are desperately trying to pivot to proof-of-stake and sharding to survive the next wave of mass hysteria without grinding to a halt under the unsustainable load. The word ‘terabyte’ can wake blockchain engineers up at night in cold sweats. For a decentralised platform based on an economically incentivised security model to safely host the multi multi multi trillion dollar valuations of the global securities and assets markets – it’s got to have one hell of a high stakes incentive mechanism. If I were a regulator and my job security depended on me not being responsible for the economy going into meltdown thanks to a 51% attack, I’d mandate that market be founded on a sensible, stable, bedrock infrastructure which has sufficient valuation and decentralised credentials to support it. I must confess I can’t predict exactly what the Bitcoin<->Ethereum bridge would look like 30 years in to the future but it may have something in common with atomic swaps, side chain pegs, Lightning/Raiden network or even decentralised oracles collateralising Ethereum staking contracts with bitcoin.

IoT:

I really hope our fridges and pacemakers are not on a blockchain.

Supply chains:

Garbage in, garbage out!

A.I.:

If the future of artificial intelligence isn’t unsettling enough, imagine network resident AIs with no owners who are able to manipulate human behaviour by bribing or paying us in Bitcoin.

The web:

Now you’re talking. The web of 30 years from now will be a peer-to-peer utopia where the cyber sun always shines. The cloud we were promised was never a cloud, we always knew that deep down, and our computers and devices have been becoming less and less ours ever since that ‘cloud’ arrived to darken the skies. Despite the data aggregation horrors of the early 21st century of course there have been amazing effects of such rich levels of global communication, publication and digital services. What we need now is the best of both worlds, ownership and control of our hardware, software and data AND the plethora of online services including end to end encrypted instant message, micro blogging, social networking, cloud data storage and back up, etc, etc. The peer-to-peer networks that put the 2000s on the map like Kazaa, eDonkey and Gnutella mostly all died but within their ashes are stirring some hot embers and I saw Tim Berners-Lee blowing gently on them the other day through a pipe made of distributed hash tables.

A web that can store and transfer more is a better web – vast scalability is a basic prerequisite. Blockchain therefore is never going to be the backbone of the web; consulting a ledger of everything that ever happened in order validate anything that will ever happen is bananas in the context of the www. Servers in fact aren’t great at scalability either as they are inherently bottlenecked and geographically bound. Swarms of distributed p2p computers can coordinate to send you a file at far higher bandwidths than a server can – especially when you compare on a cost basis. Political benefits aside even, the future of the web has to be p2p.

Cryptocurrencies (ultimately bitcoin of course) will be the economic incentive used to balance all of our collective compute resources as consumers and suppliers to this p2p web. Your TV will earn bitcoin by serving out TV programmes to your fellow webonauts, you’ll hardly know about that cash though because it will flow right out of your TV again next time you want to watch something, which gets paid for and streamed by your TV for you. (And by TV, I mean brain implant).

ISPs are the final pinch point of the internet and mesh network will make them mostly redundant. Energy efficient, long distance, multiplexing transducers will turn all of our devices into mesh networking routers. Your phone will link up with your neighbours on both sides, who in turn link up with their neighbours, their cabled connection to work, their roof top microwave antenna connection to the next town and so on. Cellular network providers and cabled broadband business models will become redundant and retreat to facilitating the long distance connections like undersea cables. Oh, yes you might be micro paying your neighbours with bitcoin to mesh with them, but they’re paying you too, so in fact there are only small residual net transfers happening from time to time – this is a great use case for the Lightning Network by the way.

22nd May 2049, 09:28:

You’ll wake up, check the news, open your email, go downstairs and open your fridge and make breakfast. The fridge is the same one you’ve had for the last 15 years but it is powered via a smart meter which trades the renewable energy market for you – you don’t care. A notification pops up that your portfolio of security tokens has been re-collateralised at an especially decent rate but again you don’t care because you’re watching videos streamed from around the world with no agencies, advertisers or publishers in the middle. The video is called “Watch teenagers trying to figure out Facebook – LOL”. You laugh and head out into the spring air delighted that massive state level mining of bitcoin helped drive the renewable energy industry to price levels that made fossil fuels forgotten except in space travel. Dolon Muskrat sends out an annual newsletter for the SpaceDAO announcing that their plans for an electrically powered space elevator are complete and construction on the ground base has begun – buy ticket tokens now – with bitcoin only, no tether accepted.