Tranquility Node are proud to announce a new free tool, this time useful for those using bitcoin options contracts to hedge or speculate on the dollar price of bitcoin.

Miners, for example, may wish to hedge against any fall in the price of Bitcoin and use options to ‘presell’ their expected trove at near current prices Speculators may wish to take the other side of that contract to benefit from the alternative outcome. There are many use cases for options and now we have a thriving and liquid market to enjoy.

Market makers may also find this tool useful for managing non-automated quotations and delta adjustments to a variety of references.

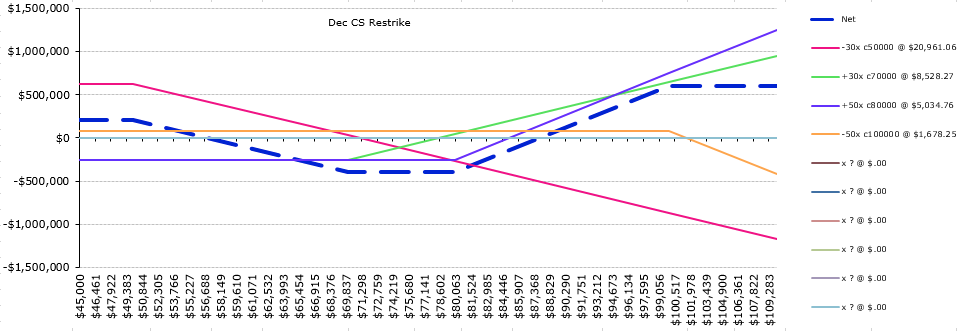

Options enable traders to refine the market risk they are exposed to. If they expect the asset price to go up over the next month by 10% with an 80% likelihood, then instead of buying the asset they can buy a call option with a suitable strike to focus their available capital on leveraging their expectation more effectively for higher return. Using options in this simple manner doesn’t require a great deal of support however combining a variety of contracts together into an even more refined strategy, such as a 105%-110% call spread, can lead to great complexity. This is where our Options Strategy Aggregator comes in to help.

We have been refining this tool for years and are now publishing it, free of charge, to help more people and businesses use options effectively.

Feedback very welcome, please get in touch via the contact details and forms on this website for support requests.

Features

- Up to 10 legs per strategy

- Duplicate the pricing grid as many times as you like to accommodate multiple live quotes

- Custom ratio the size of each leg

- Graph the payoff for complex strategies

- List the multiple breakeven prices

- Live Deribit.com options price feed

- Delta adjust structures to a pegged reference versus spot, perp or futures price

- Input OTC prices alongside to check quotes vs screen and reduce execution errors

Still in development

- Integration with Paradigm.co to spawn RFQs directly from the strategies composed

- Addition of a model pricer to give neutral marks for comparison

RFQ (Request for quote) is a method for pricing and executing multiple options contracts in one go versus market makers – something which can’t be done via traditional order books. Paradigm and Deribit work seamlessly together to enable this. The Options Strategy Aggregator can be used to design and gauge costing prior to the RFQ stage.

Requirements

- MS Windows and Excel

- Mac VBA unfortunately isn’t compatible with the xmlhttp library used to call prices from Deribit

Instructions

- Download and unzip the file linked below

- It is an MS Excel spreadsheet with VBA macros so you will need to permit them if Excel asks you

- Feel free to disable macros at first to browse the contents

- Edit just the blue text cells, the rest are formulas which will respond to your blue inputs